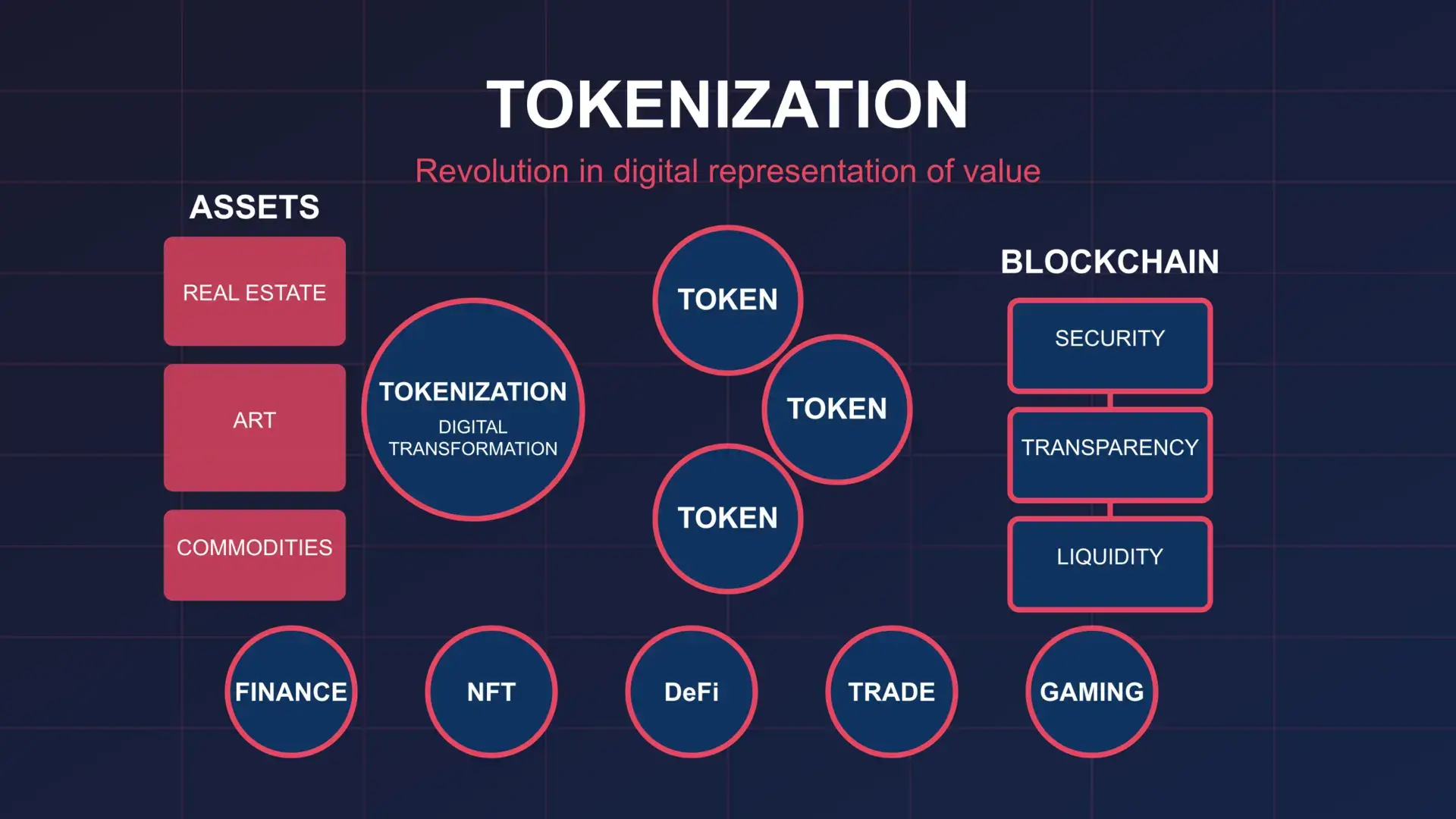

Tokenization is the process of transforming rights to assets or units of value into digital tokens that exist on a blockchain. This technology is one of the fundamental components of the financial revolution we’ve been witnessing in recent years, enabling the representation, storage, and exchange of virtually any kind of value in a digital format.

What is Tokenization?

Tokenization is the process of converting rights to assets (physical or digital) into digital tokens, which are recorded and managed on a blockchain. A token represents a specific value or ownership right and can be stored, transferred, or exchanged digitally, without the need to physically move the underlying asset.

In the context of blockchain technology, tokenization uses smart contracts to encode the rules and characteristics of tokens, providing immutability, security, and programmability.

Types of Tokens

Fungible Tokens

These are tokens that have identical value and properties, meaning they can be freely exchanged with one another. Examples include:

- Cryptocurrencies (Bitcoin, Ethereum)

- Utility tokens providing access to specific services

- Tokens representing shares in traditional financial assets

Non-Fungible Tokens (NFTs)

These are unique tokens that cannot be exchanged on a one-to-one basis due to their distinct characteristics. Examples include:

- Digital artworks

- Virtual real estate

- Collectible digital items

- Ownership certificates of unique assets

Security Tokens

These tokens represent traditional securities, such as shares, bonds, or derivatives. They are subject to regulations similar to traditional financial instruments.

Utility Tokens

These provide holders with access to specific products or services on a platform. They are not direct investments but rather “fuel” for using a particular ecosystem.

Applications of Tokenization

Financial Market

Tokenization is revolutionizing traditional financial markets by:

- Fractionalizing high-value assets (e.g., real estate, artwork)

- Increasing liquidity for traditionally illiquid assets

- Reducing transaction costs and eliminating intermediaries

- Automating dividend payouts and other investor entitlements

- Enabling 24/7 trading without geographic restrictions

Real Estate Market

Tokenizing real estate allows for:

- Purchasing shares in real estate from small amounts

- Increasing liquidity of property investments

- Automatically settling rental income

- Global real estate investment without legal or geographic barriers

Art and Collectibles

Tokenization in the art world enables:

- Digital confirmation of authenticity and provenance

- Fractional ownership of valuable artworks

- New business models for artists (e.g., royalties on resales)

- Global access to the art market

Identity and Personal Data

Tokenization can revolutionize identity management by:

- Decentralized digital identity systems

- Selective sharing of personal data

- Monetizing one’s own data on user-defined terms

Supply Chains

In logistics, tokenization enables:

- Product origin tracking

- Automated settlements between supply chain participants

- Verifying product authenticity

Benefits of Tokenization

Increased Liquidity

Tokenization allows assets to be divided into smaller units, significantly boosting their liquidity and accessibility to a broader range of investors.

Global Accessibility

Tokens can be bought and sold by investors around the world, 24/7, without geographic limitations.

Transparency

All transactions are recorded on the blockchain, ensuring full transparency and real-time auditability.

Cost Efficiency

Process automation through smart contracts eliminates intermediaries and reduces transaction costs.

Programmability

Tokens can embed advanced business logic (e.g., automatic dividend payouts, voting rules) through smart contracts.

Challenges and Barriers to Adoption

Legal Regulations

One of the biggest challenges is regulatory uncertainty and the differing approaches of regulators across jurisdictions. Many countries are working on tokenization laws, but the progress is uneven.

Technical Issues

Scalability of blockchains, interoperability between platforms, and smart contract security are significant technical barriers.

Market Acceptance

Educating potential users and investors about the benefits and risks of tokenization remains a challenge to wider adoption.

Integration with Existing Systems

Integrating tokenized assets with traditional financial and legal systems requires comprehensive technical and regulatory solutions.

The Future of Tokenization

The future of tokenization looks promising, with expected growth in the following areas:

- Real-world asset tokenization: Growth in tokenizing real estate, infrastructure, commodities, and other tangible assets.

- Institutional adoption: Banks and financial institutions are increasingly exploring tokenization of traditional assets.

- IP Tokenization: Copyrights, patents, and other forms of intellectual property will be tokenized more frequently.

- Personalized investment baskets: Possibility of creating personalized portfolios composed of shares in various tokenized assets.

- Integration with DeFi: Connecting real-world tokenized assets with decentralized finance protocols.

Summary

Tokenization is a groundbreaking technology with the potential to transform how we perceive ownership, invest, and exchange value. Despite current challenges, its ability to enhance liquidity, reduce costs, and democratize access to various asset classes makes it one of the most promising applications of blockchain technology.

As the market matures, regulatory and technical issues are resolved, and public awareness grows, tokenization could become the standard for managing digital and physical assets, unlocking new opportunities for investors, entrepreneurs, and consumers worldwide.

Leave a Reply